Learning Center: Interest and APR—What's the Difference?

You see two rates when you shop for a loan, and we explain why.

In our Fundamentals series, Rate Simple breaks down loan concepts for ordinary people.

Among all the numbers swirling around the topic of mortgages, two determine how much you pay for the loan: interest rate and annual percentage rate. Everyone knows about interest rates because they go hand-in-hand with any kind of loan. Low interest rates are water cooler conversation, inescapable in advertising, a spark that ignites an interest in buying a new home or refinancing a current home. But focusing on the interest rate without regard to APR paints an incomplete picture of how much a mortgage really costs you.

Get a Home Loan QuoteIn this article we discuss the difference between interest rate and APR and explain how useful APR can be in comparison shopping.

What Determines Each Rate?

Your credit score determines your mortgage interest rate. While credit score is not the sole factor that lenders consider, it is a major one. All things being equal, the better your credit score, the lower your interest rate. Credit score is so important that it's used up front to determine who qualifies for loans. According to MyFico.com, you need a minimum score of 620. At that score, of course, expect to pay the highest going rate.

If only the levers behind APR were as straightforward! APR is an overall view of the total cost of the loan. The APR will almost always be higher than the interest rate because it includes such additional costs as broker fees, closing costs, and mortgage insurance. These costs vary by lender. APR doesn't give you the big picture, for reasons we explain next, but it gives you a bigger picture.

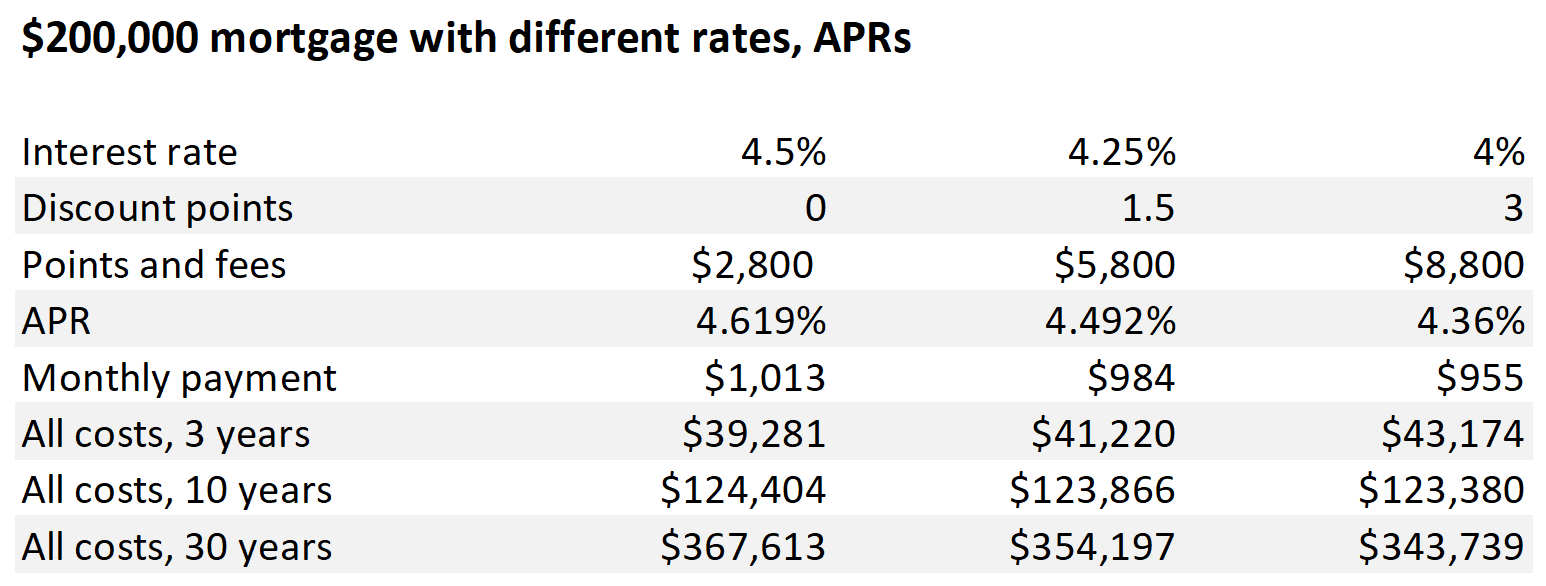

Here is an example of just how much the two percentages can change the cost of your loan:

All APRs Are Not Alike

Closing costs must be reflected in the APR by law, but lenders can leave out other costs if they choose, such as inspection fees and credit reporting. Ask lenders what is and is not included in their APR. You've heard about hidden costs? This is one place they hide.

That APRs are determined by the lender is an overlooked advantage to the consumer because it leaves room for negotiation. For example, if your preferred lender has a higher APR than a competitor, ask them to match the competitor or risk losing your business. Remember: The lender set it; the lender can lower it.

Comparing APRs lets you compare the strength of the lenders, too. Generally, a lender with a lower APR operates more efficiently (lower upfront costs) and doesn't need to spend as much to borrow money.

Time Is a Key Consideration

Because APR is closer to the truth about how much a loan will cost overall, you might conclude that a lower APR is always best. And it is—if you're planning to stay in the home for most or all of the term. (See "All costs, 30 years" in table above.) Remember that disclosing the APR was mandated to give consumers an overall view of the cost of the loan, but for that view to be most accurate the loan must run most of the term.

Not everyone plans to stay in one place that long, and for them the importance of the APR diminishes. How much the loan will have cost by the end of, say, three years could be more important. Take a look at "All costs, 3 years" in the table. In that scenario, you see that even with higher interest, a higher APR, and higher monthly payments, the overall cost after three years is lowest.

Get a Home Loan QuoteTakeaways

- You see two rates when you shop for a new loan or a refi: interest and APR.

- Difference is the interest rate is set by your credit score, the APR by the lender.

- APR includes closing costs and other fees for an overall view of the loan.

- APRs have wiggle room! Make banks compete for your business.